What is one cost of avoiding insurance?

The one cost of avoiding insurance is the price you pay to repair. Or the amount to be paid to the insurance company as the premium. The cost of avoiding insurance is the price of loss due to lack of insurance. When it comes to health, not having insurance may even lead to detrimental results.

You must be careful about the cost of avoiding insurance.

Insolvency, if confronted by a major issue, not receiving insurance de crucibles, and not having the ability to buy a car or home, is at risk of being the victim of accidents. You must check these Insurance Pitfalls Common to All.

If you are aware of the following points, ensure that you benefit from your insurance. First of all that you don’t let your money in the wrong place, which means you won’t regret acquiring insurance at all.

Ensuring your home’s value for estate property’s price of sale and reconstruction costs

If the value of real estate drops, most homeowners will believe that their insurance premiums for their homes are reduced. But, home insurances are designed to pay for expenses for rebuilding, not the value of the home.

Ensure you have enough insurance to cover the cost of rebuilding your home completely and get your belongings replaced, regardless of the real property market. Better yet, consider raising your deductible for more savings.

Selecting an insurance company by cost

When it comes down to selecting an organization, the price will be a factor. The company you choose must offer reasonable costs. Additionally, you must ensure that the insurance company has a stable financial position and is solid. It should be able to offer excellent customer service, too.

Make sure to verify the financial health of the company with rating agencies. Also, ask your friends and family members what their experience was with the insurance companies. Choose the one that can meet your needs and manage claims effectively and with fairness.

Buying the lawfully needed amount of car liability only

The idea of buying only the minimum amount is just a way to skirt the law. It is only a sign that you’ll have to pay more in the future. In the event of lawsuits, the costs could impact your financial situation. You may be able to drop comprehensive insurance and the collision of your previous automobiles. Insurance companies and consumer groups industry recommend a minimum of $300,000 per accident and $100,000 for each person of bodily injury insurance.

The importance of avoiding the flood insurance

Flood damages typically are not covered in typical homeowners or renters’ insurance policies. It is available separately from private insurance companies. Even if you’re not at risk, you should be aware that 25 percent of losses due to flooding occur in areas with relatively safe from flooding.

Weather patterns like the spring runoff triggered by snow melting in winter could result in flooding. Before buying a house, check if it is within a flood zone.

Take into less dangerous consideration areas. If you are in a flood zone, you need to take mitigation measures to minimize the chance of flooding-related damage. However, it is recommended to get flood insurance.

Avoiding renters insurance

The insurance for renters will cover the contents of your home and living expenses should you need to have to leave your home because of a catastrophe such as a hurricane or fire. Additionally, it provides insurance against liability if you have injured someone within your home and have decided to pursue an action.

Consider multi-policy discounts and consider purchasing multiple policies from the same insurance company to save more money. That can include life, auto, or rental insurance. What is the expense of not having insurance?

What causes people not to take insurance?

Insurance can be expensive.

Most people don’t want to take out life insurance because they think it’s too costly. Due to the growing living costs, life insurance isn’t a good fit in most people’s budgets. But the reality lies that insurance isn’t as costly as you think, particularly when you’re young.

Additionally, when you realize that living expenses are constantly increasing, How do you imagine your family would handle costs in the event of sudden death? Take a look at this, and you’ll understand the reason why life insurance is a good idea.

I am too young/healthy to be eligible for life insurance.

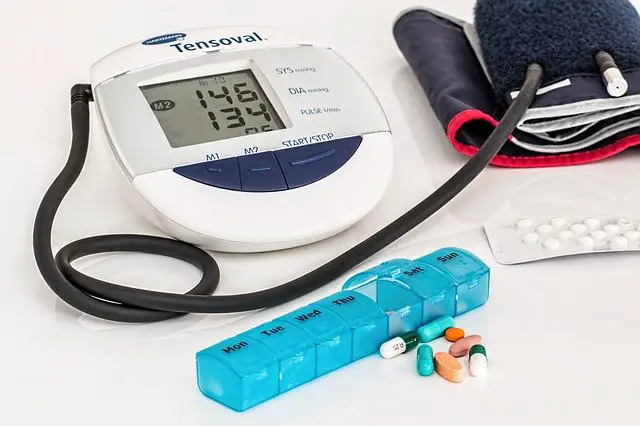

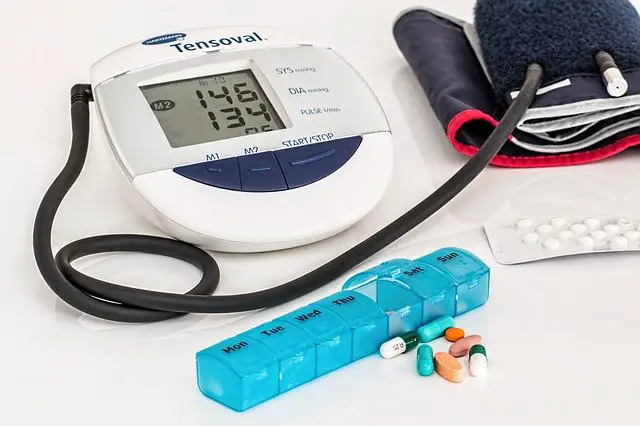

You’re healthy and young, but are you certain that everything will stay the same shortly also? A growing number of those in their 20s or 30s are affected by conditions like cholesterol, diabetes, and high blood pressure.

Life insurance is a great method of taking responsibility for the financial requirements of your family members if you die. Additionally, even the price for life insurance in your 20s and 30s is much less than those older in the 40s and 50s. Therefore, purchasing one while you’re still young can be a financially prudent choice.

My employer has bought one for me.

Yes, many businesses do offer life insurance for their employees. However, it is crucial to recognize that these are policies for groups that provide only minimal coverage. Go through the terms of the policy, and you’ll find that the amount guaranteed is not enough to meet the financial demands that your household will require.

The best time to purchase Life Insurance is now.

Many people are interested in life insurance but delay the purchase because of one or the other reason. If you’re in the same situation, you should take the time to learn about the significance of life insurance in depth. You’ll understand why it is beneficial to get one as quickly as you can. Whatever your age, young or old, fit or have an illness, are a parent and not most suitable time to buy life insurance is now.

The 4 Costs of Avoiding Insurance

- You could be in the debt trap if you are facing a serious issue.

- In the absence of a low-interest rate on a home loan or car loan

- There is no benefit to an insurance deductible.

- Risks are higher in the event of an accident.

Legal Requirements

Most states require insurance for automobile liability. The insurance will cover the medical costs and property damage for the other person injured in the incident if you’re the one responsible for the accident.

If you are the vehicle owner and allow your liability insurance to go unclaimed, you have violated the law. That applies even if you park the vehicle and don’t drive it. More importantly, driving the vehicle in a collision without insurance can incur high costs for you in a lawsuit.

If you are in a financial pinch, When you’re in a pinch, you’re looking at ways to cut down costs. It’s tempting to allow your car insurance to expire. That is not a good idea because it could lead to unexpected issues.

Health insurance covers illness or injuries as well as other costs that are not covered by your insurance. Health Insurance is one of the biggest expenses that a family budget has to bear is health insurance. Healthcare can be expensive and expensive. Healthcare is expensive because illnesses can occur quickly and abruptly. You must have been lucky enough to experience a health crisis in your life. You’ve been able to make a fortune and have a personal responsibility. The idea of having a comprehensive insurance policy for your home appears to be reasonable. Still, not every insurance companies have the same standard and at the same rate.

The necessity of having health insurance is a common-sense decision after a bit of review. The cost of health care within the United States is currently at $4 trillion per year. That is more than double the annually produced GDP in Argentina, France, and Canada. Many experts predict that it will increase with the aging of the population. To manage the rising cost, it is essential to expand the coverage, and the ever-changing technology of health insurance businesses comes to the rescue.

Why not be insured and pay cash when you might get affordable insurance?

What is One cost of avoiding health insurance?

Health insurance is an agreement between you and the insurance company. When you sign up for a plan, the insurer accepts to cover a portion of your medical bills if you are injured or sick.

Other benefits are also a part of health insurance. Plans offered on Connect For Health Colorado Marketplace Connect To Health Colorado Marketplace (and most other plans) offer free preventive services, including vaccinations screenings, check-ups, and vaccinations. They also cover certain costs of prescription drugs. In addition, health insurance can allow you to gain access to doctors who can meet with you to discuss your specific medical needs.

Health Insurance protects you from unexpected, high costs.

Did you know that the average cost for a 3-day hospitalization is $30,000? For instance, fixing the broken leg can be as high as $7,500? A health insurance plan can keep you from costly unexpected expenses like those.

What is the process for determining Health Insurance Coverage Works?

When you’re insured, you have to pay for some expenses while your policy covers certain amounts:

- Premium: A premium is an amount that you must contribute to your insurance plan generally each month. It is due even if you don’t need medical treatment that month.

- Deductible: Suppose you require medical attention, and a deductible applies. It will be the sum you have to pay for treatment before your insurance company begins to pay its portion. When you have reached your deductible, the insurance company will begin to cover certain costs associated with your treatment. Certain insurance plans offer lower deductibles, for example, $250. Certain plans have higher deductibles, for example, $2,000. A lot of plans offer preventive services as well as other services after you’ve reached the deductible.

- Co-pay: Co-pay refers to a set amount you pay for medical services. For instance, a visit to the doctor’s office could cost you $150 if you don’t have insurance. If you have coverage through health insurance, you can pay only $25, and your health insurance plan will pay the remainder.

- Coinsurance: Coinsurance is similar to co-pay but is an amount of the costs you have to pay. For example, you might pay 20% of $200 in medical bills. Thus, you’d pay $40, and the health insurance company will pay the remainder.

What Insurance Protections Do You Have?

Insurance coverage can protect you from high medical expenses:

- Out-of-pocket limit The maximum amount you’ll need to pay in case you become sick. For instance, suppose your plan provides an out-of-pocket maximum. After you have paid $3,000 in coinsurance, deductibles, and co-pays, your plan will pay for health care that is covered over the amount for the remainder throughout the entire year.

- There are no lifetime or annual limits for health plans: Health plans do not limit their annual or lifetime usage. When you’ve reached the out-of-pocket limit, the insurance provider will cover all of your medical expenses covered by the plan without a limitation.

Individuals who do not have health insurance are vulnerable to these expenses. It is possible for people who do not have coverage to have deep debt or even bankruptcy.

What is one cost of avoiding insurance?

The one cost of avoiding insurance is the price you pay to repair. Or the amount to be paid to the insurance company as the premium. The cost of avoiding insurance is the price of loss due to lack of insurance. When it comes to health, not having insurance may even lead to detrimental results.

You must be careful about the cost of avoiding insurance.

Insolvency, if confronted by a major issue, not receiving insurance de crucibles, and not having the ability to buy a car or home, is at risk of being the victim of accidents. You must check these Insurance Pitfalls Common to All.

If you are aware of the following points, ensure that you benefit from your insurance. First of all that you don’t let your money in the wrong place, which means you won’t regret acquiring insurance at all.

Ensuring your home’s value for estate property’s price of sale and reconstruction costs

If the value of real estate drops, most homeowners will believe that their insurance premiums for their homes are reduced. But, home insurances are designed to pay for expenses for rebuilding, not the value of the home.

Ensure you have enough insurance to cover the cost of rebuilding your home completely and get your belongings replaced, regardless of the real property market. Better yet, consider raising your deductible for more savings.

Selecting an insurance company by cost

When it comes down to selecting an organization, the price will be a factor. The company you choose must offer reasonable costs. Additionally, you must ensure that the insurance company has a stable financial position and is solid. It should be able to offer excellent customer service, too.

Make sure to verify the financial health of the company with rating agencies. Also, ask your friends and family members what their experience was with the insurance companies. Choose the one that can meet your needs and manage claims effectively and with fairness.

Buying the lawfully needed amount of car liability only

The idea of buying only the minimum amount is just a way to skirt the law. It is only a sign that you’ll have to pay more in the future. In the event of lawsuits, the costs could impact your financial situation. You may be able to drop comprehensive insurance and the collision of your previous automobiles. Insurance companies and consumer groups industry recommend a minimum of $300,000 per accident and $100,000 for each person of bodily injury insurance.

The importance of avoiding the flood insurance

Flood damages typically are not covered in typical homeowners or renters’ insurance policies. It is available separately from private insurance companies. Even if you’re not at risk, you should be aware that 25 percent of losses due to flooding occur in areas with relatively safe from flooding.

Weather patterns like the spring runoff triggered by snow melting in winter could result in flooding. Before buying a house, check if it is within a flood zone.

Take into less dangerous consideration areas. If you are in a flood zone, you need to take mitigation measures to minimize the chance of flooding-related damage. However, it is recommended to get flood insurance.

Avoiding renters insurance

The insurance for renters will cover the contents of your home and living expenses should you need to have to leave your home because of a catastrophe such as a hurricane or fire. Additionally, it provides insurance against liability if you have injured someone within your home and have decided to pursue an action.

Consider multi-policy discounts and consider purchasing multiple policies from the same insurance company to save more money. That can include life, auto, or rental insurance. What is the expense of not having insurance?

What causes people not to take insurance?

Insurance can be expensive.

Most people don’t want to take out life insurance because they think it’s too costly. Due to the growing living costs, life insurance isn’t a good fit in most people’s budgets. But the reality lies that insurance isn’t as costly as you think, particularly when you’re young.

Additionally, when you realize that living expenses are constantly increasing, How do you imagine your family would handle costs in the event of sudden death? Take a look at this, and you’ll understand the reason why life insurance is a good idea.

I am too young/healthy to be eligible for life insurance.

You’re healthy and young, but are you certain that everything will stay the same shortly also? A growing number of those in their 20s or 30s are affected by conditions like cholesterol, diabetes, and high blood pressure.

Life insurance is a great method of taking responsibility for the financial requirements of your family members if you die. Additionally, even the price for life insurance in your 20s and 30s is much less than those older in the 40s and 50s. Therefore, purchasing one while you’re still young can be a financially prudent choice.

My employer has bought one for me.

Yes, many businesses do offer life insurance for their employees. However, it is crucial to recognize that these are policies for groups that provide only minimal coverage. Go through the terms of the policy, and you’ll find that the amount guaranteed is not enough to meet the financial demands that your household will require.

The best time to purchase Life Insurance is now.

Many people are interested in life insurance but delay the purchase because of one or the other reason. If you’re in the same situation, you should take the time to learn about the significance of life insurance in depth. You’ll understand why it is beneficial to get one as quickly as you can. Whatever your age, young or old, fit or have an illness, are a parent and not most suitable time to buy life insurance is now.

The 4 Costs of Avoiding Insurance

- You could be in the debt trap if you are facing a serious issue.

- In the absence of a low-interest rate on a home loan or car loan

- There is no benefit to an insurance deductible.

- Risks are higher in the event of an accident.

Legal Requirements

Most states require insurance for automobile liability. The insurance will cover the medical costs and property damage for the other person injured in the incident if you’re the one responsible for the accident.

If you are the vehicle owner and allow your liability insurance to go unclaimed, you have violated the law. That applies even if you park the vehicle and don’t drive it. More importantly, driving the vehicle in a collision without insurance can incur high costs for you in a lawsuit.

If you are in a financial pinch, When you’re in a pinch, you’re looking at ways to cut down costs. It’s tempting to allow your car insurance to expire. That is not a good idea because it could lead to unexpected issues.

Health insurance covers illness or injuries as well as other costs that are not covered by your insurance. Health Insurance is one of the biggest expenses that a family budget has to bear is health insurance. Healthcare can be expensive and expensive. Healthcare is expensive because illnesses can occur quickly and abruptly. You must have been lucky enough to experience a health crisis in your life. You’ve been able to make a fortune and have a personal responsibility. The idea of having a comprehensive insurance policy for your home appears to be reasonable. Still, not every insurance companies have the same standard and at the same rate.

The necessity of having health insurance is a common-sense decision after a bit of review. The cost of health care within the United States is currently at $4 trillion per year. That is more than double the annually produced GDP in Argentina, France, and Canada. Many experts predict that it will increase with the aging of the population. To manage the rising cost, it is essential to expand the coverage, and the ever-changing technology of health insurance businesses comes to the rescue.

Why not be insured and pay cash when you might get affordable insurance?

What is One cost of avoiding health insurance?

Health insurance is an agreement between you and the insurance company. When you sign up for a plan, the insurer accepts to cover a portion of your medical bills if you are injured or sick.

Other benefits are also a part of health insurance. Plans offered on Connect For Health Colorado Marketplace Connect To Health Colorado Marketplace (and most other plans) offer free preventive services, including vaccinations screenings, check-ups, and vaccinations. They also cover certain costs of prescription drugs. In addition, health insurance can allow you to gain access to doctors who can meet with you to discuss your specific medical needs.

Health Insurance protects you from unexpected, high costs.

Did you know that the average cost for a 3-day hospitalization is $30,000? For instance, fixing the broken leg can be as high as $7,500? A health insurance plan can keep you from costly unexpected expenses like those.

What is the process for determining Health Insurance Coverage Works?

When you’re insured, you have to pay for some expenses while your policy covers certain amounts:

- Premium: A premium is an amount that you must contribute to your insurance plan generally each month. It is due even if you don’t need medical treatment that month.

- Deductible: Suppose you require medical attention, and a deductible applies. It will be the sum you have to pay for treatment before your insurance company begins to pay its portion. When you have reached your deductible, the insurance company will begin to cover certain costs associated with your treatment. Certain insurance plans offer lower deductibles, for example, $250. Certain plans have higher deductibles, for example, $2,000. A lot of plans offer preventive services as well as other services after you’ve reached the deductible.

- Co-pay: Co-pay refers to a set amount you pay for medical services. For instance, a visit to the doctor’s office could cost you $150 if you don’t have insurance. If you have coverage through health insurance, you can pay only $25, and your health insurance plan will pay the remainder.

- Coinsurance: Coinsurance is similar to co-pay but is an amount of the costs you have to pay. For example, you might pay 20% of $200 in medical bills. Thus, you’d pay $40, and the health insurance company will pay the remainder.

What Insurance Protections Do You Have?

Insurance coverage can protect you from high medical expenses:

- Out-of-pocket limit The maximum amount you’ll need to pay in case you become sick. For instance, suppose your plan provides an out-of-pocket maximum. After you have paid $3,000 in coinsurance, deductibles, and co-pays, your plan will pay for health care that is covered over the amount for the remainder throughout the entire year.

- There are no lifetime or annual limits for health plans: Health plans do not limit their annual or lifetime usage. When you’ve reached the out-of-pocket limit, the insurance provider will cover all of your medical expenses covered by the plan without a limitation.

Individuals who do not have health insurance are vulnerable to these expenses. It is possible for people who do not have coverage to have deep debt or even bankruptcy.