Global economic impact on Russia invading Ukraine | What should the USA do ?

This article will discuss the global economic impact of Russia invading Ukraine. As Russia have declared war with Ukraine, it has affected many markets around the world.

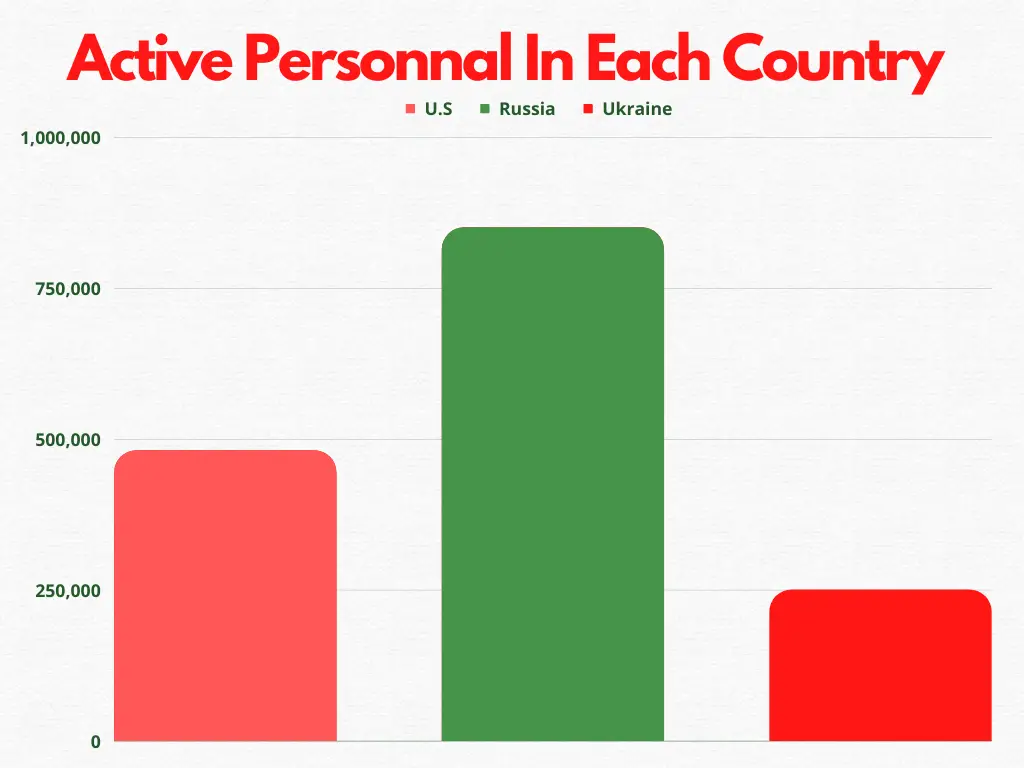

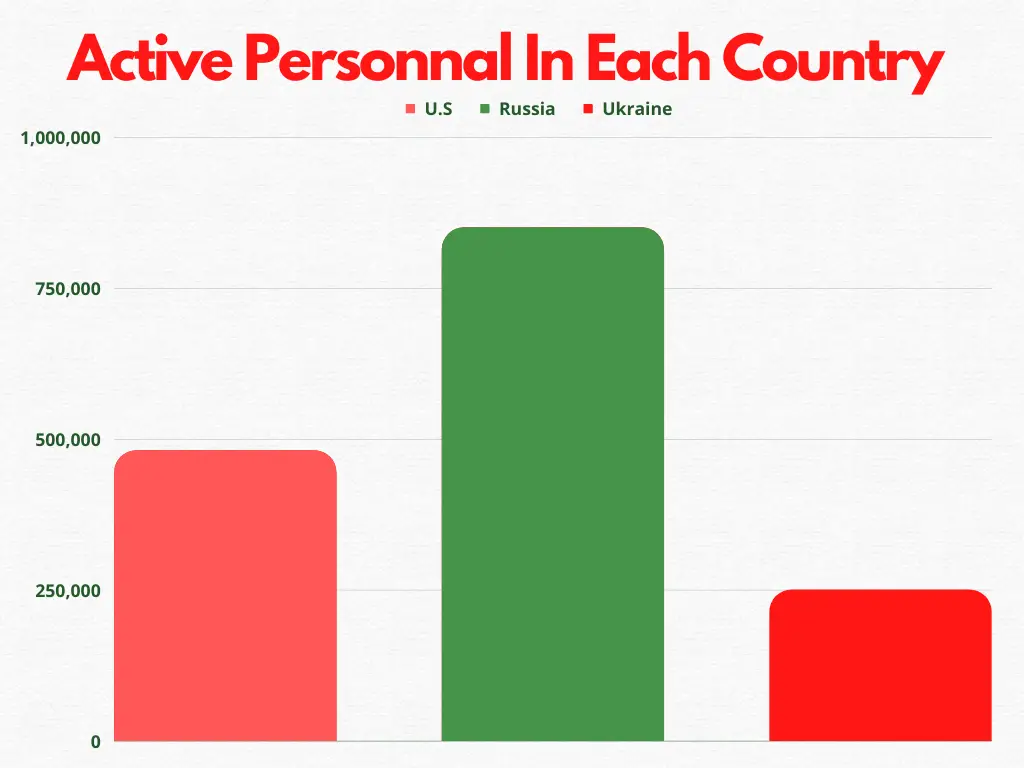

Comparing military power between Russia and Ukraine and the USA

Although Ukraine has never produced its nuclear power, Russia is the second most crucial state in researching, developing, and striking nuclear weapons. On the other hand, the USA was the first country to develop and military use nuclear warheads globally.

The USA spends a large amount of money on military expenditures. At the same time, Ukraine spends only $5.4 billion on military expenditures, whereas Russia spends about $61.1 billion on military expenditures.

Global economic impact

As Ukraine and Russia are on the edge of the conflict, financial markets and economists are far more preoccupied with when and how much the US Federal Reserve will lift some interest rates.

However, some leading global market analysts were already warning that the risk of the war and even the costs of uneasy peace are also being underpriced. Chief among all of them is Rabobank’s global strategist Micheal Every.

“We are in the unusual position of global headlines and politicians warning of the risk of a major war, and yet markets — until very recently — remain mostly unconcerned,” this is what he wrote this week.

Beyond the shares and the other financial markets, the crisis is already pushing up the price of oil and gas and the critical metals used for almost everything from making cars and electronics to construction and kitchenware.

But rather than solely focusing only on the short-term implications of a Russia-Ukraine conflict on the commodity supplies and the prices, Mr. Every also has decided to take an intense dive into the longer-term ramifications under the different scenarios. So now, we will explain some of the impacts that will occur.

Oil and gas

In the short term, it is also widely acknowledged that a Russia-Ukraine war, also the limited one, would spark a further massive rise in the oil and gas prices, especially in Europe.

Russia supplies about 30 percent of Europe’s oil and 35 percent of its natural gas, which would be just cut off in the conflict.

Rabobank’s energy analysts also believe that it could push the oil prices up from already-elevated levels of about $US90 a barrel to around $US125, with the gas prices following higher.

RBC’s head of the global commodity strategy, Helima Croft, also believes that prices will just head higher in the event of Russian supplies being disrupted, despite the Us government’s efforts just to source the alternatives.

However, suppose it takes heavy sanctions against Russia to avoid the conflict. In that case, Rabobank warns that the price impact may be even more severe. Assuming that all countries halt purchases of Russian energy, the potential price impact would be huge, with the oil rising to $US175 and European gas to around $US250, the report forecast.

However, it is also noted it was also unlikely that all countries would comply, with China likely to support Russia through very big purchases, and even the EU unlikely to give up Russian energy completely. That could also mean higher prices in countries applying the sanctions and lower prices for those still willing to buy Russian oil and gas.

Food and fertilizers

Other vital commodities may also be just hit by either war or the sanctions, with Russia the world’s biggest wheat grower and Ukraine in around the top four. In addition, significant production of corn, barley, sunflower, and rapeseed might also be affected.

While most of the other countries, including Australia, might also be able to compensate for some of the loss in the supply, they might also be facing a handicap: fertilizer. Rabobank estimated 23 percent of ammonia,17 percent of potash,14 percent of the area, and 10 percent of phosphates are just shipped from Russia.

When China has already reserved much of the output of urea and the phosphates also for domestic use, losing the Russian products would also lead to further shortages and rising prices for the key fertilizer ingredients.

Financial markets

Rabobank also predicted that either the war or heavy sanctions could also see a flight to safety on the financial markets, pushing the bond prices up and the interest rates are lower. This also might be a compelling counterweight to a current trend towards the rising interest rates across many advanced economies.

However, the picture could be complicated by even much higher inflation driven by the potential commodity shortages outlined above. Just how much of the central banks are willing to look through the inflation caused by the foreign sources outside of their control is yet to be truly tested in the current period as the Fed also prepares to raise the US interest rates at the end of March.

Ironically as an extension to the period of the low-interest rates might also help arrest the recent market sell-off, although the offset of even either a cold or hot conflict involving the EU, Russia, the US, and potentially even China, and the global supply also disruptions inherent in that, might as far outweigh the benefits of the lower rates for much longer.

On the front currency, Rabobank also expects that the US dollar, Swiss franc, Japanese yen, and gold would be the most obvious go-to’s in the event of the conflict. Russia’s ruble also would slump in the event of either war or sanctions, and the euro would also be most likely to be out of favor.

Metal and manufacturing

Manufacturing supply chains might also not be immune to either a conflict or sanctions against Russia. Russia’s share of global nickel exports is estimated to be about 49 percent, palladium 42 percent, platinum 13 percent, still 7 percent, and copper 4 percent.

In some of this sense, a hostile peace with long-lasting sanctions could also be a much more threatening prospect for the supply and the cost of these commodities than the disruption from a short, sharp war. Of course, both sanctions and war could also occur.

Conclusion

In this article, we have explained in detail the Global impact of Russia on invading Ukraine. We have discussed all of them very briefly. We recommend you do some research of your own to get the best results.

Global economic impact on Russia invading Ukraine | What should the USA do ?

This article will discuss the global economic impact of Russia invading Ukraine. As Russia have declared war with Ukraine, it has affected many markets around the world.

Comparing military power between Russia and Ukraine and the USA

Although Ukraine has never produced its nuclear power, Russia is the second most crucial state in researching, developing, and striking nuclear weapons. On the other hand, the USA was the first country to develop and military use nuclear warheads globally.

The USA spends a large amount of money on military expenditures. At the same time, Ukraine spends only $5.4 billion on military expenditures, whereas Russia spends about $61.1 billion on military expenditures.

Global economic impact

As Ukraine and Russia are on the edge of the conflict, financial markets and economists are far more preoccupied with when and how much the US Federal Reserve will lift some interest rates.

However, some leading global market analysts were already warning that the risk of the war and even the costs of uneasy peace are also being underpriced. Chief among all of them is Rabobank’s global strategist Micheal Every.

“We are in the unusual position of global headlines and politicians warning of the risk of a major war, and yet markets — until very recently — remain mostly unconcerned,” this is what he wrote this week.

Beyond the shares and the other financial markets, the crisis is already pushing up the price of oil and gas and the critical metals used for almost everything from making cars and electronics to construction and kitchenware.

But rather than solely focusing only on the short-term implications of a Russia-Ukraine conflict on the commodity supplies and the prices, Mr. Every also has decided to take an intense dive into the longer-term ramifications under the different scenarios. So now, we will explain some of the impacts that will occur.

Oil and gas

In the short term, it is also widely acknowledged that a Russia-Ukraine war, also the limited one, would spark a further massive rise in the oil and gas prices, especially in Europe.

Russia supplies about 30 percent of Europe’s oil and 35 percent of its natural gas, which would be just cut off in the conflict.

Rabobank’s energy analysts also believe that it could push the oil prices up from already-elevated levels of about $US90 a barrel to around $US125, with the gas prices following higher.

RBC’s head of the global commodity strategy, Helima Croft, also believes that prices will just head higher in the event of Russian supplies being disrupted, despite the Us government’s efforts just to source the alternatives.

However, suppose it takes heavy sanctions against Russia to avoid the conflict. In that case, Rabobank warns that the price impact may be even more severe. Assuming that all countries halt purchases of Russian energy, the potential price impact would be huge, with the oil rising to $US175 and European gas to around $US250, the report forecast.

However, it is also noted it was also unlikely that all countries would comply, with China likely to support Russia through very big purchases, and even the EU unlikely to give up Russian energy completely. That could also mean higher prices in countries applying the sanctions and lower prices for those still willing to buy Russian oil and gas.

Food and fertilizers

Other vital commodities may also be just hit by either war or the sanctions, with Russia the world’s biggest wheat grower and Ukraine in around the top four. In addition, significant production of corn, barley, sunflower, and rapeseed might also be affected.

While most of the other countries, including Australia, might also be able to compensate for some of the loss in the supply, they might also be facing a handicap: fertilizer. Rabobank estimated 23 percent of ammonia,17 percent of potash,14 percent of the area, and 10 percent of phosphates are just shipped from Russia.

When China has already reserved much of the output of urea and the phosphates also for domestic use, losing the Russian products would also lead to further shortages and rising prices for the key fertilizer ingredients.

Financial markets

Rabobank also predicted that either the war or heavy sanctions could also see a flight to safety on the financial markets, pushing the bond prices up and the interest rates are lower. This also might be a compelling counterweight to a current trend towards the rising interest rates across many advanced economies.

However, the picture could be complicated by even much higher inflation driven by the potential commodity shortages outlined above. Just how much of the central banks are willing to look through the inflation caused by the foreign sources outside of their control is yet to be truly tested in the current period as the Fed also prepares to raise the US interest rates at the end of March.

Ironically as an extension to the period of the low-interest rates might also help arrest the recent market sell-off, although the offset of even either a cold or hot conflict involving the EU, Russia, the US, and potentially even China, and the global supply also disruptions inherent in that, might as far outweigh the benefits of the lower rates for much longer.

On the front currency, Rabobank also expects that the US dollar, Swiss franc, Japanese yen, and gold would be the most obvious go-to’s in the event of the conflict. Russia’s ruble also would slump in the event of either war or sanctions, and the euro would also be most likely to be out of favor.

Metal and manufacturing

Manufacturing supply chains might also not be immune to either a conflict or sanctions against Russia. Russia’s share of global nickel exports is estimated to be about 49 percent, palladium 42 percent, platinum 13 percent, still 7 percent, and copper 4 percent.

In some of this sense, a hostile peace with long-lasting sanctions could also be a much more threatening prospect for the supply and the cost of these commodities than the disruption from a short, sharp war. Of course, both sanctions and war could also occur.

Conclusion

In this article, we have explained in detail the Global impact of Russia on invading Ukraine. We have discussed all of them very briefly. We recommend you do some research of your own to get the best results.