How Much Should You Save From Each Paycheck?

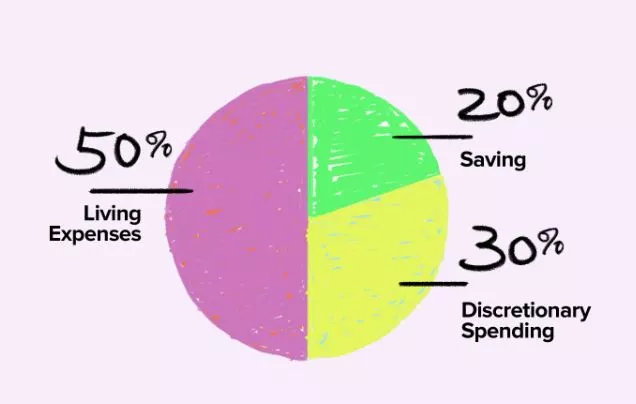

The general recommendation is to set aside 20% of each paycheck for savings. This relates to a common budgeting principle known as the 50-30-20 method, which states that you should set aside 20% of your income for savings and investments and 50% of your income for needs, wants, and savings. a week ago

Saving for retirement is an essential task that everyone should strive to complete. Depending on your circumstances, you can divide your monthly income into monthly savings and figure out how much money you need to save for your future. Then, it would be best if you considered putting that money into a secure account that earns higher interest. Once you’ve calculated how much money you need to save each month, you can decide how much to put aside each paycheck.

Savings

When deciding how much money to save each month, you need to figure out your financial goals and how much you can realistically expect to save each month. For example, if you want to buy a house within two years, you may need to save more money than the average worker. Or, if you want to retire early, you may need to save more than the average worker. To find out how much you should be saving each month, you can break down your budget by category and account. Then, you should monitor your progress, remembering that even a tiny amount helps.

In addition to your retirement savings, you should also set aside some money for emergencies. An emergency fund is a savings account that will replace lost income in an emergency. It will also help you cover unexpected expenses, such as an unexpected car breakdown or emergency. Once the emergency has passed, the emergency savings will be replenished. You can also set aside money for short-term goals, such as Christmas gift savings or wedding planning. The key is to save money for these short-term goals and keep the funds liquid.

You may find it difficult to save a large chunk of money, especially if you are already heavily in debt. However, if you’ve paid off your debt, you can put more money toward saving an emergency fund. This way, you’ll have more money to use in the future and be ready to face any unexpected situation. In addition, saving money can help you make it through tough times, whether it’s a baby or retirement.

Automated withdrawals

There are many benefits to setting up automatic withdrawals from each paycheck. You won’t have to worry about forgetting to make the withdrawal, and your money will grow automatically. You can also save for your retirement and invest without thinking about it, so you’ll have more time for the things you enjoy. You’ll need your name and routing number to set up an automatic withdrawal from each paycheck. Most financial institutions and services offer this service online, but you can also set it up in person or over the phone.

Automated payments are convenient for many people. They can pay bills and recurring payments, such as car payments and gym memberships, without thinking about them. Depending on your circumstances, you can also get an interest rate reduction from your lender if you pay your bills automatically. But before you set up automatic payments, you should understand how they work and be cautious with the details. For example, if you give out your bank account information to companies or individuals, check with the company before letting them start using your money.

50/30/20 rule of thumb

The 50/30/20 rule can help save money from each paycheck. It divides your income into needs, wants, and savings. Needs are the daily expenses that you cannot live without. Wants are the extra luxuries you may want but don’t necessarily need. You can save money for rainy days by reducing your spending on these items. Once you understand this rule, you can adjust your budget to be as close as possible to it.

The first step to learning the 50/30/20 rule is to total your income. But this isn’t as easy as it sounds. Collecting your last six paychecks and determining your average income is best. Only then can you begin saving money from each paycheck. Ultimately, saving money from each paycheck requires discipline, which isn’t easy for everyone. But you can adjust the rule to suit your needs and financial goals.

The 50/30/20 rule isn’t intended to limit your enjoyment of life – it’s meant to make you more aware of how much money you have. It will also help you identify the areas of your life where you overspend. For instance, if you’re considering purchasing a new pair of shoes or a fancy ring, ask yourself, “Can I live without this?” Then, decide whether you need or want that item.

Remember, the 50/30/20 rule is a guideline – you should experiment with it and adjust your budget to suit your needs. A 50/30/20 budget can help you get started, but a successful money-saving plan can also help you stay in debt. Of course, you must be prepared to sacrifice your wants to save. Just be sure to have a solid plan to save money from each paycheck.

We are setting aside money for savings.

One of the easiest ways to increase your savings is to set aside a set amount from each paycheck. You can set a specific percentage or even a monthly amount to save. For example, you could set aside 10% of your paycheck or $200 monthly. This will put money into your savings account every month. In addition, this will allow you to build up savings for larger goals. You can also set up a direct deposit into a savings account to save money.

If you have a second checking account, you can set up automatic transfers of a percentage of your paycheck to your savings account. This will help you stay away from temptation and allow you to save more money. Of course, you can always set up a monthly amount if you can’t set up automatic transfers. You may want to start with a smaller amount and gradually increase it over time. Saving a small amount monthly is a great way to increase your savings.

A general rule of thumb is to set aside 10% of your gross income to save. However, the actual number may vary for different people. For example, if you need to buy a home in two years, you’ll probably need to set aside more than 20% of your income. Likewise, if you want to retire early, you may need more money than the average worker. So, once you know how much you can save, you’ll be able to set a percentage for savings.

While this strategy may seem daunting initially, it can be done over time. Set aside a small amount of money every week or paycheck, and eventually, you’ll be saving for your big day. It’s also essential to have some liquid savings available for emergencies. For example, a $25 weekly savings account could be worth $2,600 in two years. The same principle applies if you put aside $50 a week. At the end of two years, you’ll have an emergency fund of $7,800.

Finding extra money to save from the paycheck

Most people would like enough money to pay their bills and live comfortably. Unfortunately, many people don’t have higher-paying jobs, and budgeting can be very challenging. However, there are ways to stretch your paycheck and live frugally. While budgeting isn’t exciting, it is necessary if you want to have more money for other things. It also means you won’t be as likely to spend all your money on one thing.

There is no one-size-fits-all solution when it comes to budgeting. Instead, your savings should be based on your financial goals and income level. Some people choose to save a set amount, while others use a percentage of their paycheck. In addition to a fixed amount, it can also be helpful to use the 50-30-20 budgeting approach, where you allocate fifty percent of your income to saving and 30 percent to paying off debt.

Another way to save money is to set up automated savings payments. This way, you can avoid the stress of living paycheck to paycheck. Another way to save money is to pay yourself first. For example, if you work a biweekly job, you can use the extra money to pay off your bills at the end of the month. You can also use these savings funds for your retirement. This will ensure that you have extra money when you need it most.

Another way to find extra money to save from each paycheck is to cut your essential expenses. For example, you can save by reducing your daily grocery expenses, packing your lunch to work, and driving a more affordable car. You can also save money on health care by getting a high-deductible health plan. High-deductible health insurance plans are tax-deductible, saving you money while reducing health care costs. These ways can help you save money and still be comfortable.

How Much Should You Save From Each Paycheck?

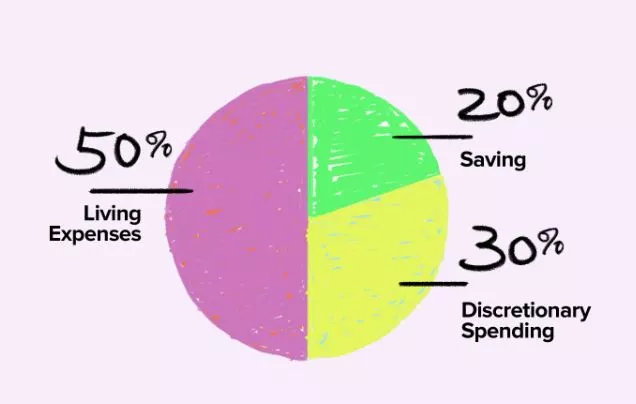

The general recommendation is to set aside 20% of each paycheck for savings. This relates to a common budgeting principle known as the 50-30-20 method, which states that you should set aside 20% of your income for savings and investments and 50% of your income for needs, wants, and savings. a week ago

Saving for retirement is an essential task that everyone should strive to complete. Depending on your circumstances, you can divide your monthly income into monthly savings and figure out how much money you need to save for your future. Then, it would be best if you considered putting that money into a secure account that earns higher interest. Once you’ve calculated how much money you need to save each month, you can decide how much to put aside each paycheck.

Savings

When deciding how much money to save each month, you need to figure out your financial goals and how much you can realistically expect to save each month. For example, if you want to buy a house within two years, you may need to save more money than the average worker. Or, if you want to retire early, you may need to save more than the average worker. To find out how much you should be saving each month, you can break down your budget by category and account. Then, you should monitor your progress, remembering that even a tiny amount helps.

In addition to your retirement savings, you should also set aside some money for emergencies. An emergency fund is a savings account that will replace lost income in an emergency. It will also help you cover unexpected expenses, such as an unexpected car breakdown or emergency. Once the emergency has passed, the emergency savings will be replenished. You can also set aside money for short-term goals, such as Christmas gift savings or wedding planning. The key is to save money for these short-term goals and keep the funds liquid.

You may find it difficult to save a large chunk of money, especially if you are already heavily in debt. However, if you’ve paid off your debt, you can put more money toward saving an emergency fund. This way, you’ll have more money to use in the future and be ready to face any unexpected situation. In addition, saving money can help you make it through tough times, whether it’s a baby or retirement.

Automated withdrawals

There are many benefits to setting up automatic withdrawals from each paycheck. You won’t have to worry about forgetting to make the withdrawal, and your money will grow automatically. You can also save for your retirement and invest without thinking about it, so you’ll have more time for the things you enjoy. You’ll need your name and routing number to set up an automatic withdrawal from each paycheck. Most financial institutions and services offer this service online, but you can also set it up in person or over the phone.

Automated payments are convenient for many people. They can pay bills and recurring payments, such as car payments and gym memberships, without thinking about them. Depending on your circumstances, you can also get an interest rate reduction from your lender if you pay your bills automatically. But before you set up automatic payments, you should understand how they work and be cautious with the details. For example, if you give out your bank account information to companies or individuals, check with the company before letting them start using your money.

50/30/20 rule of thumb

The 50/30/20 rule can help save money from each paycheck. It divides your income into needs, wants, and savings. Needs are the daily expenses that you cannot live without. Wants are the extra luxuries you may want but don’t necessarily need. You can save money for rainy days by reducing your spending on these items. Once you understand this rule, you can adjust your budget to be as close as possible to it.

The first step to learning the 50/30/20 rule is to total your income. But this isn’t as easy as it sounds. Collecting your last six paychecks and determining your average income is best. Only then can you begin saving money from each paycheck. Ultimately, saving money from each paycheck requires discipline, which isn’t easy for everyone. But you can adjust the rule to suit your needs and financial goals.

The 50/30/20 rule isn’t intended to limit your enjoyment of life – it’s meant to make you more aware of how much money you have. It will also help you identify the areas of your life where you overspend. For instance, if you’re considering purchasing a new pair of shoes or a fancy ring, ask yourself, “Can I live without this?” Then, decide whether you need or want that item.

Remember, the 50/30/20 rule is a guideline – you should experiment with it and adjust your budget to suit your needs. A 50/30/20 budget can help you get started, but a successful money-saving plan can also help you stay in debt. Of course, you must be prepared to sacrifice your wants to save. Just be sure to have a solid plan to save money from each paycheck.

We are setting aside money for savings.

One of the easiest ways to increase your savings is to set aside a set amount from each paycheck. You can set a specific percentage or even a monthly amount to save. For example, you could set aside 10% of your paycheck or $200 monthly. This will put money into your savings account every month. In addition, this will allow you to build up savings for larger goals. You can also set up a direct deposit into a savings account to save money.

If you have a second checking account, you can set up automatic transfers of a percentage of your paycheck to your savings account. This will help you stay away from temptation and allow you to save more money. Of course, you can always set up a monthly amount if you can’t set up automatic transfers. You may want to start with a smaller amount and gradually increase it over time. Saving a small amount monthly is a great way to increase your savings.

A general rule of thumb is to set aside 10% of your gross income to save. However, the actual number may vary for different people. For example, if you need to buy a home in two years, you’ll probably need to set aside more than 20% of your income. Likewise, if you want to retire early, you may need more money than the average worker. So, once you know how much you can save, you’ll be able to set a percentage for savings.

While this strategy may seem daunting initially, it can be done over time. Set aside a small amount of money every week or paycheck, and eventually, you’ll be saving for your big day. It’s also essential to have some liquid savings available for emergencies. For example, a $25 weekly savings account could be worth $2,600 in two years. The same principle applies if you put aside $50 a week. At the end of two years, you’ll have an emergency fund of $7,800.

Finding extra money to save from the paycheck

Most people would like enough money to pay their bills and live comfortably. Unfortunately, many people don’t have higher-paying jobs, and budgeting can be very challenging. However, there are ways to stretch your paycheck and live frugally. While budgeting isn’t exciting, it is necessary if you want to have more money for other things. It also means you won’t be as likely to spend all your money on one thing.

There is no one-size-fits-all solution when it comes to budgeting. Instead, your savings should be based on your financial goals and income level. Some people choose to save a set amount, while others use a percentage of their paycheck. In addition to a fixed amount, it can also be helpful to use the 50-30-20 budgeting approach, where you allocate fifty percent of your income to saving and 30 percent to paying off debt.

Another way to save money is to set up automated savings payments. This way, you can avoid the stress of living paycheck to paycheck. Another way to save money is to pay yourself first. For example, if you work a biweekly job, you can use the extra money to pay off your bills at the end of the month. You can also use these savings funds for your retirement. This will ensure that you have extra money when you need it most.

Another way to find extra money to save from each paycheck is to cut your essential expenses. For example, you can save by reducing your daily grocery expenses, packing your lunch to work, and driving a more affordable car. You can also save money on health care by getting a high-deductible health plan. High-deductible health insurance plans are tax-deductible, saving you money while reducing health care costs. These ways can help you save money and still be comfortable.