How to find 16 digit debit card number online without a card ( Or Lost card)

A lot of banks have rolled out voice recognition systems. It means that you can complete a transaction using either the debit card or your account number. One of them I use is HSBC. Let us find out the best way to find a 16 digit debit card number online without a card or lose your card. Telebanking through voice recognition has manifold advantages.

- You can access banking via your voice

- There is no need to enter your security number.

- It is safer and easier to access your account via telephone banking.

How do I sign-up to get Voice ID in HSBC?

- Contact customer service to sign up to be enrolled for Voice ID.

- Verify your security number using your phone number.

- Make a voiceprint that says “My Voice is my secret password’ as many as five times

- You can use your voice for accessing your accounts via phone banking

When you next make a call, there will be no passwords, and you’ll only have to repeat that quick, simple word. Do not worry about remembering it, and we’ll give you the right words to say every time. If you’ve lost your phone security number for the banking, you may reset the number. However, you have to register to your voice while setting up telebanking.

How does it work

Your voice is unique, just like your fingerprint, so you can make your voiceprint using us. Suppose you’ve completed your ‘voiceprint, which you’ve created. You’ll be in a position to utilize your voice for access to the telephone banking system, and we’ll be using this feature to further safeguard against fraudulent transactions.

Instead of typing two randomly generated numbers from your Bank’s telephone security code, we’ll confirm your identity by asking you to speak a brief, simple sentence.

Voice ID analyzes your voice in a matter of seconds. The AI system analyzes over 100 behavioral and physical characteristics of your voice, such as the shape and size of your mouth, you speak, and how you emphasize the words.

Security

The hackers and fraudsters might be in a position to steal or guess your security number. However, they aren’t able to duplicate your voice. It is sensitive enough to identify if someone is impersonating you or recording and recognize you when you are suffering from a sore throat or a cold. You’ll no longer need to remember the security code. After entering your account or card number, you’ll only require your voice to log into your account using telephone banking. But it is only applicable if you remember either your debit card no. or account number.

But how do I find a debit card number without a card? Suppose I lose the card?

You can either request an account change or create an account from scratch. There’s no way anyone is willing to provide this kind of information without proof of who you are or who you aren’t. You’re not able to call in or go online to show that you are. Suppose you’re a member of online banking. In that case, you can log into your account with some security questions. The other things if you lose your card are as follows.

- Call your Bank and immediately stop any transaction with your card.

- Contact Police and report your lost/stolen card.

- Visit the nearest branch of the Bank.

Call the customer care number if you need to notify the card company that the card has been stolen. After confirming your identity, you can request the customer care representative submit your request. You might receive a text from the responsible Bank. The simplest way to do this is to go to the branch that issued the debit or credit card.

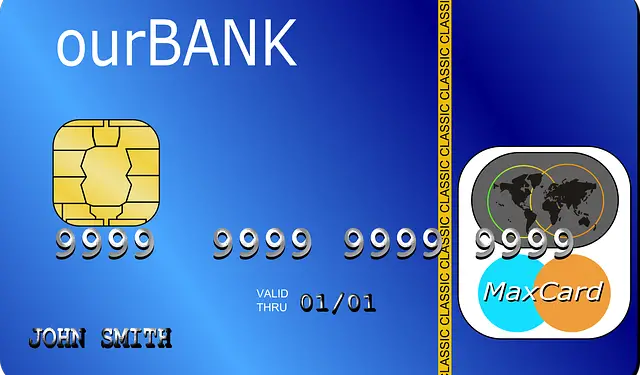

What are those 16 numbers printed on your card of the Bank mean?

Each number on the card has a special significance:

- The first six numbers identify the issuer of the card: The sequence of numbers begins with four for Visa, five for Mastercard, and three for American Express.

- The remaining nine numbers are the ones that identify this card: These nine digits may be combined to create one billion possible combinations.

- The final digit is what’s known as “the authenticity code.”

The 16 digits that appear on the back of your card are the person’s secured data. These numbers aren’t entirely random. Luhn’s algorithm can encrypt bank card data and verify bank card numbers using the check key.

How do I find the ATM card number from my account number?

The sixteen digits on your debit card are specific to your account but distinct from your account number. You’ll need to write down or enter this number while making purchases over the telephone or online. If you use GPay for online shopping, it is stored in your Google Chrome. Check your previous text messages after any online shopping. You may be lucky. I would recommend some downloadable apps for your mobile. These are places where you can hide private photos and lock them with a password. Why don’t you take a picture of your debit card front side and save it there? So in a critical situation, every small tip like this comes handy.

How to find a 16 digit debit card number online?

Debit Card is internally tied to bank systems and account numbers to protect you. The number is printed on debit cards. Suppose it is lost or stolen. Log in to your bank account. You may be lucky to get the debit cards and credit cards associated with your account. There you will find the 16 digit debit card number.

Contact your Bank if all other options fail.

Contact the number printed on the reverse of your credit card or find the customer support number. You will likely need to give your address, name, and social security number to ensure they can confirm your identity. They’ll then give you the account number. If you write it down, ensure you keep it in a secure location, such as your wallet or filing cabinet.

What is a visual cryptogram?

The visual cryptogram, also known as CVV, is a unique identifier that increases the security of the card used for payment and the transactions that arise from it. It assists in reducing the risk of piracy or fraud caused by bank data issued during the payment process.

The CVV comprises three digits that identify the card and the person who holds it. It is a reliable security measure because the cryptogram is not visible on the documents issued by banks or financial institutions. For instance, you won’t see its signature on statements from credit cards or invoices.

It’s also not stored by online stores regardless of whether you choose to register your bank card to pay faster. The CVV will be required regularly.

Most e-commerce sites require the CVV’s input when making online transactions. That also regulates the buying process with 3D Secure, which all trustworthy websites utilize. So be vigilant when you’re not requested for this essential 3-digit code!

It is crucial to understand the exact location of the CVV to help you make purchases more quickly and avoid being dissatisfied when you are completing an expenditure.

Also, the location of CVV on the card is different according to the Bank. Customers who have the Mastercard and a Visa card will notice the digital cryptogram visible on their card, which is attached to the area reserved for the cardholder’s signature. Some banks like to place it next to the unique 16-digit code on the front of the card.

Find out the expiration date for your ATM card at the Bank.

You are probably aware that banks cards come with an expiration date, no exception. It is often referred to as the “expiration date.” Contrary to what many believe, Debit card numbers are perishable and are susceptible to wear and tear. After two to three years, the chip on your payment card could become unmagnetized. The chip also is vulnerable to scratches. The banks have put an automatic renewal system to ease your life in place. There is no need to do anything. You will be issued the new credit or debit card approximately a week before the expiration date of your current card. This process is automatic and doesn’t require an additional fee.

How can I find my debit card’s account number?

Go to the Bank’s website on a laptop or computer, or launch their mobile application on your tablet or phone. Log in and click the tab to see the summary of the account. Usually, your account number will appear in this section. If not, look on the site or use the “Help” or “Help” function to find the account number.

In reality, there’s nothing that can be compared to Debit Card account numbers, and here are two opportunities

- You’re looking for your debit card number

- You’re looking for the number of your bank account

How to find your debit card number?

If you’d like to find your debit card’s number (debit card number.) Here is a step-by-step guide to finding your debit card’s number.

- Get your debit card physical or soft copy (Screenshots/images).

- Check the front of your debit card.

- There is a 16-digit number printed on or written on the left. It’s easily identified numerous times, highlighted in different colors, sizes, colors, etc.

- That is your 16-digit debit card number. It is valid for a while with the expiry date and your name.

How to find your Bank account number?

Your account number appears on each bank statement every month. Look for a recent bank statement and search for 10-12 numbers that read “Account Number.” It’s typically found near the bottom of the page, located on either the right or left-hand sides.

Your financial institution uniquely provides your Bank account number. The account number can be found under the name of the card. On the front of the debit card, a 16-digit code is printed. The first six digits are bank identification numbers. The remaining ten numbers are known as the Unique account number of the card owner.

Other methods to locate your bank account’s number are as follows:

- Log into your Internet banking account and locate your bank account’s number here. You can find your branch’s IFSC code.

- Contact your Bank’s customer service agent to verify your identity, and they’ll inform you.

- Download your monthly bank statement sent to your registered email to the account. Sometimes, this download document might ask you to enter the password in PDF format. After you enter the correct password, you will find the account’s number and IFSC number, reward point, etc.

- If you’ve got your checkbook, then you will find the bank account number on your check’s bottom.

Second way

I assume that you need to find your bank account number, not your debit card’s number. The debit card no and your bank account number are different things.

The number on your account is never changed (unless you alter your type of account). However, the debit card number can vary based on the frequency at which you have your debit card upgraded or replaced. You’re confusing yourself by calling it the debit card number.

A debit card’s number is typically mentioned on the card’s front of the card itself. It is a 16-digit code either printed or embossed onto the card. This number is used for online transactions.

The bank account number or simply the account number is the ID provided for your bank account. Some debit cards include your account’s number in the card under your name.

If the account number you have isn’t listed, alternative ways to locate the account number are available.

- Log into your online banking account, and then locate your account number within the page of welcome.

- You can also contact customer service and ask for your bank account number by authenticating your identity.

- Go to the closest ATM and use your debit card to print the statement from your Bank. In the case of most banks, this will appear on the statement.

- If you’ve registered to use mobile banking services, you can log in to your account and check the account information.

- The account number appears on your check if they are present.

- The account number will also be visible on the statements you get via email.

How to find the Debit card number and CVV without the card, but you have all the information?

Without access to your card, the average person can’t get the ATM card’s number even if it has all the information. You need to know about the ATM card’s numbers (16 (or earlier, 19 numbers.) You may have to go to your branch for more information about this issue. Suppose your ATM card is lost and you want to get the card’s data. In that case, it is necessary to go to the branch, or you can submit a request by mentioning your account number to a bank’s official. They (Bank authorized) may inquire by entering the account number in the system to find that the account does not have the number or CIN (customer identification number). You will also know which cards linked the CIF at the account level. The only other way is to log on to your back account portal and check the debit card statement. If you are lucky, you may see the Debit card number there.

How to find 16 digit debit card number online without a card ( Or Lost card)

A lot of banks have rolled out voice recognition systems. It means that you can complete a transaction using either the debit card or your account number. One of them I use is HSBC. Let us find out the best way to find a 16 digit debit card number online without a card or lose your card. Telebanking through voice recognition has manifold advantages.

- You can access banking via your voice

- There is no need to enter your security number.

- It is safer and easier to access your account via telephone banking.

How do I sign-up to get Voice ID in HSBC?

- Contact customer service to sign up to be enrolled for Voice ID.

- Verify your security number using your phone number.

- Make a voiceprint that says “My Voice is my secret password’ as many as five times

- You can use your voice for accessing your accounts via phone banking

When you next make a call, there will be no passwords, and you’ll only have to repeat that quick, simple word. Do not worry about remembering it, and we’ll give you the right words to say every time. If you’ve lost your phone security number for the banking, you may reset the number. However, you have to register to your voice while setting up telebanking.

How does it work

Your voice is unique, just like your fingerprint, so you can make your voiceprint using us. Suppose you’ve completed your ‘voiceprint, which you’ve created. You’ll be in a position to utilize your voice for access to the telephone banking system, and we’ll be using this feature to further safeguard against fraudulent transactions.

Instead of typing two randomly generated numbers from your Bank’s telephone security code, we’ll confirm your identity by asking you to speak a brief, simple sentence.

Voice ID analyzes your voice in a matter of seconds. The AI system analyzes over 100 behavioral and physical characteristics of your voice, such as the shape and size of your mouth, you speak, and how you emphasize the words.

Security

The hackers and fraudsters might be in a position to steal or guess your security number. However, they aren’t able to duplicate your voice. It is sensitive enough to identify if someone is impersonating you or recording and recognize you when you are suffering from a sore throat or a cold. You’ll no longer need to remember the security code. After entering your account or card number, you’ll only require your voice to log into your account using telephone banking. But it is only applicable if you remember either your debit card no. or account number.

But how do I find a debit card number without a card? Suppose I lose the card?

You can either request an account change or create an account from scratch. There’s no way anyone is willing to provide this kind of information without proof of who you are or who you aren’t. You’re not able to call in or go online to show that you are. Suppose you’re a member of online banking. In that case, you can log into your account with some security questions. The other things if you lose your card are as follows.

- Call your Bank and immediately stop any transaction with your card.

- Contact Police and report your lost/stolen card.

- Visit the nearest branch of the Bank.

Call the customer care number if you need to notify the card company that the card has been stolen. After confirming your identity, you can request the customer care representative submit your request. You might receive a text from the responsible Bank. The simplest way to do this is to go to the branch that issued the debit or credit card.

What are those 16 numbers printed on your card of the Bank mean?

Each number on the card has a special significance:

- The first six numbers identify the issuer of the card: The sequence of numbers begins with four for Visa, five for Mastercard, and three for American Express.

- The remaining nine numbers are the ones that identify this card: These nine digits may be combined to create one billion possible combinations.

- The final digit is what’s known as “the authenticity code.”

The 16 digits that appear on the back of your card are the person’s secured data. These numbers aren’t entirely random. Luhn’s algorithm can encrypt bank card data and verify bank card numbers using the check key.

How do I find the ATM card number from my account number?

The sixteen digits on your debit card are specific to your account but distinct from your account number. You’ll need to write down or enter this number while making purchases over the telephone or online. If you use GPay for online shopping, it is stored in your Google Chrome. Check your previous text messages after any online shopping. You may be lucky. I would recommend some downloadable apps for your mobile. These are places where you can hide private photos and lock them with a password. Why don’t you take a picture of your debit card front side and save it there? So in a critical situation, every small tip like this comes handy.

How to find a 16 digit debit card number online?

Debit Card is internally tied to bank systems and account numbers to protect you. The number is printed on debit cards. Suppose it is lost or stolen. Log in to your bank account. You may be lucky to get the debit cards and credit cards associated with your account. There you will find the 16 digit debit card number.

Contact your Bank if all other options fail.

Contact the number printed on the reverse of your credit card or find the customer support number. You will likely need to give your address, name, and social security number to ensure they can confirm your identity. They’ll then give you the account number. If you write it down, ensure you keep it in a secure location, such as your wallet or filing cabinet.

What is a visual cryptogram?

The visual cryptogram, also known as CVV, is a unique identifier that increases the security of the card used for payment and the transactions that arise from it. It assists in reducing the risk of piracy or fraud caused by bank data issued during the payment process.

The CVV comprises three digits that identify the card and the person who holds it. It is a reliable security measure because the cryptogram is not visible on the documents issued by banks or financial institutions. For instance, you won’t see its signature on statements from credit cards or invoices.

It’s also not stored by online stores regardless of whether you choose to register your bank card to pay faster. The CVV will be required regularly.

Most e-commerce sites require the CVV’s input when making online transactions. That also regulates the buying process with 3D Secure, which all trustworthy websites utilize. So be vigilant when you’re not requested for this essential 3-digit code!

It is crucial to understand the exact location of the CVV to help you make purchases more quickly and avoid being dissatisfied when you are completing an expenditure.

Also, the location of CVV on the card is different according to the Bank. Customers who have the Mastercard and a Visa card will notice the digital cryptogram visible on their card, which is attached to the area reserved for the cardholder’s signature. Some banks like to place it next to the unique 16-digit code on the front of the card.

Find out the expiration date for your ATM card at the Bank.

You are probably aware that banks cards come with an expiration date, no exception. It is often referred to as the “expiration date.” Contrary to what many believe, Debit card numbers are perishable and are susceptible to wear and tear. After two to three years, the chip on your payment card could become unmagnetized. The chip also is vulnerable to scratches. The banks have put an automatic renewal system to ease your life in place. There is no need to do anything. You will be issued the new credit or debit card approximately a week before the expiration date of your current card. This process is automatic and doesn’t require an additional fee.

How can I find my debit card’s account number?

Go to the Bank’s website on a laptop or computer, or launch their mobile application on your tablet or phone. Log in and click the tab to see the summary of the account. Usually, your account number will appear in this section. If not, look on the site or use the “Help” or “Help” function to find the account number.

In reality, there’s nothing that can be compared to Debit Card account numbers, and here are two opportunities

- You’re looking for your debit card number

- You’re looking for the number of your bank account

How to find your debit card number?

If you’d like to find your debit card’s number (debit card number.) Here is a step-by-step guide to finding your debit card’s number.

- Get your debit card physical or soft copy (Screenshots/images).

- Check the front of your debit card.

- There is a 16-digit number printed on or written on the left. It’s easily identified numerous times, highlighted in different colors, sizes, colors, etc.

- That is your 16-digit debit card number. It is valid for a while with the expiry date and your name.

How to find your Bank account number?

Your account number appears on each bank statement every month. Look for a recent bank statement and search for 10-12 numbers that read “Account Number.” It’s typically found near the bottom of the page, located on either the right or left-hand sides.

Your financial institution uniquely provides your Bank account number. The account number can be found under the name of the card. On the front of the debit card, a 16-digit code is printed. The first six digits are bank identification numbers. The remaining ten numbers are known as the Unique account number of the card owner.

Other methods to locate your bank account’s number are as follows:

- Log into your Internet banking account and locate your bank account’s number here. You can find your branch’s IFSC code.

- Contact your Bank’s customer service agent to verify your identity, and they’ll inform you.

- Download your monthly bank statement sent to your registered email to the account. Sometimes, this download document might ask you to enter the password in PDF format. After you enter the correct password, you will find the account’s number and IFSC number, reward point, etc.

- If you’ve got your checkbook, then you will find the bank account number on your check’s bottom.

Second way

I assume that you need to find your bank account number, not your debit card’s number. The debit card no and your bank account number are different things.

The number on your account is never changed (unless you alter your type of account). However, the debit card number can vary based on the frequency at which you have your debit card upgraded or replaced. You’re confusing yourself by calling it the debit card number.

A debit card’s number is typically mentioned on the card’s front of the card itself. It is a 16-digit code either printed or embossed onto the card. This number is used for online transactions.

The bank account number or simply the account number is the ID provided for your bank account. Some debit cards include your account’s number in the card under your name.

If the account number you have isn’t listed, alternative ways to locate the account number are available.

- Log into your online banking account, and then locate your account number within the page of welcome.

- You can also contact customer service and ask for your bank account number by authenticating your identity.

- Go to the closest ATM and use your debit card to print the statement from your Bank. In the case of most banks, this will appear on the statement.

- If you’ve registered to use mobile banking services, you can log in to your account and check the account information.

- The account number appears on your check if they are present.

- The account number will also be visible on the statements you get via email.

How to find the Debit card number and CVV without the card, but you have all the information?

Without access to your card, the average person can’t get the ATM card’s number even if it has all the information. You need to know about the ATM card’s numbers (16 (or earlier, 19 numbers.) You may have to go to your branch for more information about this issue. Suppose your ATM card is lost and you want to get the card’s data. In that case, it is necessary to go to the branch, or you can submit a request by mentioning your account number to a bank’s official. They (Bank authorized) may inquire by entering the account number in the system to find that the account does not have the number or CIN (customer identification number). You will also know which cards linked the CIF at the account level. The only other way is to log on to your back account portal and check the debit card statement. If you are lucky, you may see the Debit card number there.