Social Security Hardship Payments Explained

A hardship payment is an amount equal to an applicant’s initial installment of a social security pension or benefits paid at grant, or the initial installment which is paid immediately after resumption of payment, to help people in extreme financial hardship, including those released from prison.

A hardship payment is usually not available if you are just low on cash or ought to cover an unexpected expense.

Social security program

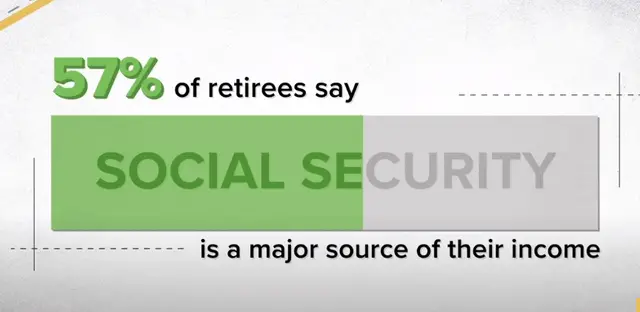

Social Security is a federal program that gives benefits to retirees who paid into the system during their working years, people who are unable to work because of physical or mental problems, and beneficiaries’ surviving family members.

How social security functions

Social Security is funded by a 12.4% tax split between workers and employers and people who work for themselves pay the entire 12.4%. This tax money goes into two Social Security trust financing which are the Old-Age and Survivors Insurance (OASI) Trust Fund and the Disability Insurance (DI) Trust Fund.

These funds of the trust are used by the Social Security Administration to pay welfare benefits and administrative costs. Unused funds are retained in trust funds and engaged in Treasury bonds.

The difference between SSI and SSDI

The most major difference is that SSI is primarily based on age/disability, in addition to restrained budget and resources, while SSDI is primarily based on disability and project credits.

Furthermore, in most states, SSI recipients are automatically eligible for Medicaid health care coverage. After 24 months of taking disability payments, an individual with SSDI will be automatically eligible for Medicare.

Hardship advance payment

Hardship payments are primarily made to people receiving Jobseeker’s Allowance, Work opportunities, and Support Allowance, or Universal Credit who have had their benefits cut out and want money to accumulate daily requirements or heating, or those that are vulnerable or look after people who are homeless.

Most people who apply for hardship payments are those whose benefits have been cut out due to being sanctioned for failing to meet the terms of their applicant commitment or missing important interviews or appointments.

A hassle deposit can’t be made while a grant is backdated. This is due to the reason that an advance may be paid if the person is required to attend till the give up of its first installment period.

Amount of a hardship advance payment

Hardship payments are primarily made to people receiving Jobseeker’s Allowance, Work opportunities, and Support Allowance, or Universal Credit who have had their benefits cut out and want money to accumulate daily requirements or heating, or those that are vulnerable or look after people who are homeless

The delegate must not advance more than 7 days, or the time duration of days claimable in the claimant’s initial installment, whichever is less. This will guard the claimant against going too long. In extraordinary cases, the representative also can moreover beautify more than 7 days, but not more than days payable within the claimant’s first installment.

Applying for a hardship payment

You can only qualify for a hardship installment if you receive the following:

- Allowance for Job Seekers (JSA)

- Allowance for Employment and Support (ESA)

- The Universal Credit system (UC)

To be eligible for a hardship payment, you should be unable to pay for essentials and have had your JSA or ESA personal allowance and all of your UCS grant cut. Payments are made to people aged 18 and up, though 16 and 17-year-olds may qualify in certain circumstances.

You must show that you have no other finances or savings, that you are unable to borrow from family or friends, and that you have first sought other forms of assistance or income, like help from your local authority or a charity. You must be ready to provide evidence to show that you will be in desperate need.

Paying back hardship payment

Right now, if you get ESA or JSA, you are not asked to pay back hardship payments. If you receive Universal Credit, you will then be asked to repay the money.

When your sanction expires, money is usually deducted from your UC account until you have repaid the entire hardship payment. If this is going to put you in debt, you must ask your job coach to make the repayments more manageable. You can get help from a debt counselor to do this.

Amount received from hardship payment

Universal Credit hardship transactions are calculated at 60% of your regular UC payment. If your reason to apply for a hardship payment is extremely serious, you may be eligible for up to 80% of your regular payments.

You may be eligible for a higher salary if you or your partner are expecting a baby or are seriously ill. If your application has been approved, you will be able to get hardship payments for the duration of your sanction. If you are sanctioned again, you must reapply for a hardship payment.

Evidence to show when applying for hardship payments

When individuals adopt for a hardship payment, you must provide evidence.

This may include:

- Birth certificates are required for any dependents.

- Evidence of any disabilities or health issues that you or your dependents may have.

- demonstrating that you’ve looked into other ways to get the money you’re asking for, such as asking friends, family, or nonprofits for financial assistance

- attempting to cut non-essential costs, such as canceling subscriptions or reducing shopping

- They may request a bank statement or make copies of your budget to see where your money is going.

- Your bank statement may also show if you do have other income sources or savings that can be used instead of just a hardship payment.

Time duration for hardship payment to be received

If you meet the criteria for a hardship payment, the funds should be deposited directly into the applicant’s account or just on the date your coming benefit payment is due.

Hardship advance payments for released prisoners

People who have been freed from prison or psychiatric institutions may be eligible for a hardship preliminary payment under the same conditions as those of other claimants.

Social Security Hardship Payments Explained

A hardship payment is an amount equal to an applicant’s initial installment of a social security pension or benefits paid at grant, or the initial installment which is paid immediately after resumption of payment, to help people in extreme financial hardship, including those released from prison.

A hardship payment is usually not available if you are just low on cash or ought to cover an unexpected expense.

Social security program

Social Security is a federal program that gives benefits to retirees who paid into the system during their working years, people who are unable to work because of physical or mental problems, and beneficiaries’ surviving family members.

How social security functions

Social Security is funded by a 12.4% tax split between workers and employers and people who work for themselves pay the entire 12.4%. This tax money goes into two Social Security trust financing which are the Old-Age and Survivors Insurance (OASI) Trust Fund and the Disability Insurance (DI) Trust Fund.

These funds of the trust are used by the Social Security Administration to pay welfare benefits and administrative costs. Unused funds are retained in trust funds and engaged in Treasury bonds.

The difference between SSI and SSDI

The most major difference is that SSI is primarily based on age/disability, in addition to restrained budget and resources, while SSDI is primarily based on disability and project credits.

Furthermore, in most states, SSI recipients are automatically eligible for Medicaid health care coverage. After 24 months of taking disability payments, an individual with SSDI will be automatically eligible for Medicare.

Hardship advance payment

Hardship payments are primarily made to people receiving Jobseeker’s Allowance, Work opportunities, and Support Allowance, or Universal Credit who have had their benefits cut out and want money to accumulate daily requirements or heating, or those that are vulnerable or look after people who are homeless.

Most people who apply for hardship payments are those whose benefits have been cut out due to being sanctioned for failing to meet the terms of their applicant commitment or missing important interviews or appointments.

A hassle deposit can’t be made while a grant is backdated. This is due to the reason that an advance may be paid if the person is required to attend till the give up of its first installment period.

Amount of a hardship advance payment

Hardship payments are primarily made to people receiving Jobseeker’s Allowance, Work opportunities, and Support Allowance, or Universal Credit who have had their benefits cut out and want money to accumulate daily requirements or heating, or those that are vulnerable or look after people who are homeless

The delegate must not advance more than 7 days, or the time duration of days claimable in the claimant’s initial installment, whichever is less. This will guard the claimant against going too long. In extraordinary cases, the representative also can moreover beautify more than 7 days, but not more than days payable within the claimant’s first installment.

Applying for a hardship payment

You can only qualify for a hardship installment if you receive the following:

- Allowance for Job Seekers (JSA)

- Allowance for Employment and Support (ESA)

- The Universal Credit system (UC)

To be eligible for a hardship payment, you should be unable to pay for essentials and have had your JSA or ESA personal allowance and all of your UCS grant cut. Payments are made to people aged 18 and up, though 16 and 17-year-olds may qualify in certain circumstances.

You must show that you have no other finances or savings, that you are unable to borrow from family or friends, and that you have first sought other forms of assistance or income, like help from your local authority or a charity. You must be ready to provide evidence to show that you will be in desperate need.

Paying back hardship payment

Right now, if you get ESA or JSA, you are not asked to pay back hardship payments. If you receive Universal Credit, you will then be asked to repay the money.

When your sanction expires, money is usually deducted from your UC account until you have repaid the entire hardship payment. If this is going to put you in debt, you must ask your job coach to make the repayments more manageable. You can get help from a debt counselor to do this.

Amount received from hardship payment

Universal Credit hardship transactions are calculated at 60% of your regular UC payment. If your reason to apply for a hardship payment is extremely serious, you may be eligible for up to 80% of your regular payments.

You may be eligible for a higher salary if you or your partner are expecting a baby or are seriously ill. If your application has been approved, you will be able to get hardship payments for the duration of your sanction. If you are sanctioned again, you must reapply for a hardship payment.

Evidence to show when applying for hardship payments

When individuals adopt for a hardship payment, you must provide evidence.

This may include:

- Birth certificates are required for any dependents.

- Evidence of any disabilities or health issues that you or your dependents may have.

- demonstrating that you’ve looked into other ways to get the money you’re asking for, such as asking friends, family, or nonprofits for financial assistance

- attempting to cut non-essential costs, such as canceling subscriptions or reducing shopping

- They may request a bank statement or make copies of your budget to see where your money is going.

- Your bank statement may also show if you do have other income sources or savings that can be used instead of just a hardship payment.

Time duration for hardship payment to be received

If you meet the criteria for a hardship payment, the funds should be deposited directly into the applicant’s account or just on the date your coming benefit payment is due.

Hardship advance payments for released prisoners

People who have been freed from prison or psychiatric institutions may be eligible for a hardship preliminary payment under the same conditions as those of other claimants.