What Does AMP Provide on the Flexa Network?

Amp (AMP) is an Ethereum token that seeks to “collateralize Flexa Network payments, making them instant and secure.” If a BTC or ETH payment fails due to unconfirmed or lengthy transaction times.

If you’re considering using Flexa’s platform, you might be wondering what exactly AMP provides. A cryptocurrency is a form of transaction insurance that helps you make passive income by staking its tokens. It also has several other benefits, including a measure of the health of the network and passive income from staking its tokens. Read on to discover more!

AMP is a form of transaction insurance

AMP is a cryptocurrency that enables instant payment authorizations between merchants and consumers. Developed by Flexa and ConsenSys, AMP is an ERC-20-compatible token that acts as crowdsourced collateral for payment transactions. Amp is staked for Flexa’s crypto network apps in return for providing collateral. As a result, Flexa can guarantee payments in any currency through AMP, extending the advantages of Distributed Ledger Technology to merchant-consumer payment interactions.

Amp is distributed to its holders on a proportional basis on the Flexa network. Each merchant’s fee is a small percentage-based, lower than the prevailing interchange rate. The fees are paid in advance. Participants who want to receive rewards, in the long run, reduce the circulating supply, adding supply pressure to the Amp token. This situation could become worse as Flexa onboards more collateral managers.

AMP is a utility token on the Flexa network. It is used as collateral until the crypto is converted into money. Most coins are volatile, so using AMP as collateral means that every transaction on the Flexa network is backed up. If a cryptocurrency transaction fails, the AMP is sold instead. This allows users to avoid worrying about their token’s value dilution.

To solve these problems, the Flexa network introduced Transformers, which allow another layer of two scaling solutions to connect with it. These transformers are designed to guarantee Lightning payments from fraudulent or stolen users. In exchange for providing the collateral, Flexa uses the Amp in smart contracts. Stakers earn network rewards based on the volume of payments made with the Flexa network. This ensures the security of payments for merchants.

Amp is a digital collateral token built on Ethereum. It enables instant transactions involving digital assets and is used by networks to secure transactions. The Amp project claims to provide a versatile interface for collateralization through a system of partitions and collateral managers. Smart contracts can lock, release, and redirect collateral. The Flexa network collateral manager is the first implementation of Amp. It will allow DeFi platforms to integrate the technology into their products.

As cryptocurrency adoption continues to gain momentum, the price of AMP is expected to increase. Early entrants will see the highest gains in the coming years. Grayscale, one of the largest asset management firms in the world, has invested in AMP and plans to add new features and assets for collateralization. This will increase Amp’s value, enabling the platform to attract institutional investors.

Flexa has increased its digital currency acceptance capabilities as the leading provider of pure-digital payments. Its AMPs allow merchants to accept digital currencies while guaranteeing zero fraud. By leveraging existing blockchain verification systems and its collateralization platform, AMP ensures the security and efficiency of digital currency payments. The AMP is a form of transaction insurance on the Flexa network.

It provides a measure of the network’s health

The Amp (AMP) is a digital asset that measures the Flexa network’s health. The Amp token has a market cap of $25 million. It is considered the third-largest cryptocurrency in terms of fiat value stolen. However, the Amp was not the only stolen asset. Cream Finance lost 418 million AMP and 1,308 Ethereum during a similar attack in August. The total value of AMP in August was approximately $25 million, and Cream Finance also lost $37.5 million in a flash loan attack in February.

Flexa/Amp is a revolutionary blockchain platform that utilizes decentralization, blockchain, and smart contract technologies to transfer value. As Flexa/Amp continues to expand its network of partners, its price increases, forcing investors to purchase more AMP. This is a significant value driver for Amp and should not be overlooked. However, it is important to note that the Amp is not a perfect investment. Investors should keep this in mind when investing in the Flexa network.

The Amp token is the most popular cryptocurrency among consumers. Its value is determined by its staking yield, around 3.9%. The higher the number of AMP tokens a user holds, the more Flexa payments will be processed. In addition, AMP’s staking yield is sustainably generated, so users need not worry about their token value decreasing.

The Amp token is the native utility token of the Flexa network. It is used as collateral until cryptocurrency is converted. Then, the Amp tokens are distributed among users to spread the risk. In addition, the Flexa network can process up to $1.4 billion in transactions, and Amp tokens are guaranteed against fraud and default. Coin investors can also use the Amp tokens to collateralize their trades. In some cases, they are compensated in return for their services.

Amp’s unique solution to a small problem on the blockchain is a major boon for cryptocurrencies. Traditionally, it was necessary to have a digital wallet with the recipient’s wallet address to send money. When the network became overloaded, it took days to settle these transactions. But without transactions, the cryptocurrency would not trade at current market caps. The Amp token is a perfect example of a cryptocurrency’s ability to resolve this common issue.

The Amp token is the primary open-source token that powers Flexa’s network. It was designed to solve a serious transaction security problem by providing a secure forum from source to settlement. The Flexa network also offers dozens of cryptos and a stable team. Despite its young age, the Flexa network has a rapidly growing merchant list and a robust team. In addition, Flexa plans to add fraud-proof Lightning Network payments to its network in 2021.

It allows users to generate passive income by staking AMP tokens

The AMP is a cryptocurrency that enables users to earn extra tokens by staking. By staking, users can lock their holdings in a smart contract and receive a portion of rewards. This type of staking helps the Flexa network maintain its security and the community’s growth. The more AMP tokens that are staked, the higher the rewards for stakers.

AMP is a form of transaction insurance whereby users can earn passive income by staking the coins on the Flexa network. This payment method is popular with cryptocurrency investors because it allows them to take advantage of instant payment solutions while being protected against losses due to fraudulent transactions. The AMP token is a decentralized form of transaction insurance. It is a key part of the Flexa network’s security infrastructure.

Amp is a native cryptocurrency of the Flexa network. Flexa aims to integrate digital currencies into the daily lives of users. The network supports cryptocurrencies by making them available to merchants and giving consumers an alternative to FIAT currencies. However, it is not without risks. To minimize the risks associated with transferring funds, Amp has been designed to minimize the risks of the transfer of funds over unsecure networks.

The annual percentage yield of Amp varies based on the number of transactions that occur in the wallet. It is equivalent to the percentage of fees that the wallet’s users generate on Flexa. AMP holders can also earn interest by staking the tokens on Coinbase. The more AMP they own, the higher the annual percentage yield will be.

This form of meta-staking is an opportunity for AMP to benefit from the rising market price. While it is difficult to predict when a cryptocurrency will reach a certain price, the AMP token’s price may go up or down depending on various factors. If the market rebounds, AMP will increase in price over the next five years. However, suppose you’re unsure about the future of AMP. In that case, it is best to seek professional advice before investing in the AMP cryptocurrency.

Staking is a popular method for earning passive income in the crypto world. It has recently reached a market cap of $280 billion. The rewards for staking AMP tokens on the Flexa network are comparable to bank savings. In addition to securing the network’s ecosystem, the staking process rewards validators in the same cryptocurrency as the money deposited in the account.

AMP coin is the native cryptocurrency of the Flexa network. It was launched in September 2020. As a relatively new project, it is still on its way to achieving wider adoption. It provides:

- Secure and convenient payment methods.

- A non-inflationary fixed supply.

- Collateral services.

It can also be used to secure items through the Flexa network.

What Does AMP Provide on the Flexa Network?

Amp (AMP) is an Ethereum token that seeks to “collateralize Flexa Network payments, making them instant and secure.” If a BTC or ETH payment fails due to unconfirmed or lengthy transaction times.

If you’re considering using Flexa’s platform, you might be wondering what exactly AMP provides. A cryptocurrency is a form of transaction insurance that helps you make passive income by staking its tokens. It also has several other benefits, including a measure of the health of the network and passive income from staking its tokens. Read on to discover more!

AMP is a form of transaction insurance

AMP is a cryptocurrency that enables instant payment authorizations between merchants and consumers. Developed by Flexa and ConsenSys, AMP is an ERC-20-compatible token that acts as crowdsourced collateral for payment transactions. Amp is staked for Flexa’s crypto network apps in return for providing collateral. As a result, Flexa can guarantee payments in any currency through AMP, extending the advantages of Distributed Ledger Technology to merchant-consumer payment interactions.

Amp is distributed to its holders on a proportional basis on the Flexa network. Each merchant’s fee is a small percentage-based, lower than the prevailing interchange rate. The fees are paid in advance. Participants who want to receive rewards, in the long run, reduce the circulating supply, adding supply pressure to the Amp token. This situation could become worse as Flexa onboards more collateral managers.

AMP is a utility token on the Flexa network. It is used as collateral until the crypto is converted into money. Most coins are volatile, so using AMP as collateral means that every transaction on the Flexa network is backed up. If a cryptocurrency transaction fails, the AMP is sold instead. This allows users to avoid worrying about their token’s value dilution.

To solve these problems, the Flexa network introduced Transformers, which allow another layer of two scaling solutions to connect with it. These transformers are designed to guarantee Lightning payments from fraudulent or stolen users. In exchange for providing the collateral, Flexa uses the Amp in smart contracts. Stakers earn network rewards based on the volume of payments made with the Flexa network. This ensures the security of payments for merchants.

Amp is a digital collateral token built on Ethereum. It enables instant transactions involving digital assets and is used by networks to secure transactions. The Amp project claims to provide a versatile interface for collateralization through a system of partitions and collateral managers. Smart contracts can lock, release, and redirect collateral. The Flexa network collateral manager is the first implementation of Amp. It will allow DeFi platforms to integrate the technology into their products.

As cryptocurrency adoption continues to gain momentum, the price of AMP is expected to increase. Early entrants will see the highest gains in the coming years. Grayscale, one of the largest asset management firms in the world, has invested in AMP and plans to add new features and assets for collateralization. This will increase Amp’s value, enabling the platform to attract institutional investors.

Flexa has increased its digital currency acceptance capabilities as the leading provider of pure-digital payments. Its AMPs allow merchants to accept digital currencies while guaranteeing zero fraud. By leveraging existing blockchain verification systems and its collateralization platform, AMP ensures the security and efficiency of digital currency payments. The AMP is a form of transaction insurance on the Flexa network.

It provides a measure of the network’s health

The Amp (AMP) is a digital asset that measures the Flexa network’s health. The Amp token has a market cap of $25 million. It is considered the third-largest cryptocurrency in terms of fiat value stolen. However, the Amp was not the only stolen asset. Cream Finance lost 418 million AMP and 1,308 Ethereum during a similar attack in August. The total value of AMP in August was approximately $25 million, and Cream Finance also lost $37.5 million in a flash loan attack in February.

Flexa/Amp is a revolutionary blockchain platform that utilizes decentralization, blockchain, and smart contract technologies to transfer value. As Flexa/Amp continues to expand its network of partners, its price increases, forcing investors to purchase more AMP. This is a significant value driver for Amp and should not be overlooked. However, it is important to note that the Amp is not a perfect investment. Investors should keep this in mind when investing in the Flexa network.

The Amp token is the most popular cryptocurrency among consumers. Its value is determined by its staking yield, around 3.9%. The higher the number of AMP tokens a user holds, the more Flexa payments will be processed. In addition, AMP’s staking yield is sustainably generated, so users need not worry about their token value decreasing.

The Amp token is the native utility token of the Flexa network. It is used as collateral until cryptocurrency is converted. Then, the Amp tokens are distributed among users to spread the risk. In addition, the Flexa network can process up to $1.4 billion in transactions, and Amp tokens are guaranteed against fraud and default. Coin investors can also use the Amp tokens to collateralize their trades. In some cases, they are compensated in return for their services.

Amp’s unique solution to a small problem on the blockchain is a major boon for cryptocurrencies. Traditionally, it was necessary to have a digital wallet with the recipient’s wallet address to send money. When the network became overloaded, it took days to settle these transactions. But without transactions, the cryptocurrency would not trade at current market caps. The Amp token is a perfect example of a cryptocurrency’s ability to resolve this common issue.

The Amp token is the primary open-source token that powers Flexa’s network. It was designed to solve a serious transaction security problem by providing a secure forum from source to settlement. The Flexa network also offers dozens of cryptos and a stable team. Despite its young age, the Flexa network has a rapidly growing merchant list and a robust team. In addition, Flexa plans to add fraud-proof Lightning Network payments to its network in 2021.

It allows users to generate passive income by staking AMP tokens

The AMP is a cryptocurrency that enables users to earn extra tokens by staking. By staking, users can lock their holdings in a smart contract and receive a portion of rewards. This type of staking helps the Flexa network maintain its security and the community’s growth. The more AMP tokens that are staked, the higher the rewards for stakers.

AMP is a form of transaction insurance whereby users can earn passive income by staking the coins on the Flexa network. This payment method is popular with cryptocurrency investors because it allows them to take advantage of instant payment solutions while being protected against losses due to fraudulent transactions. The AMP token is a decentralized form of transaction insurance. It is a key part of the Flexa network’s security infrastructure.

Amp is a native cryptocurrency of the Flexa network. Flexa aims to integrate digital currencies into the daily lives of users. The network supports cryptocurrencies by making them available to merchants and giving consumers an alternative to FIAT currencies. However, it is not without risks. To minimize the risks associated with transferring funds, Amp has been designed to minimize the risks of the transfer of funds over unsecure networks.

The annual percentage yield of Amp varies based on the number of transactions that occur in the wallet. It is equivalent to the percentage of fees that the wallet’s users generate on Flexa. AMP holders can also earn interest by staking the tokens on Coinbase. The more AMP they own, the higher the annual percentage yield will be.

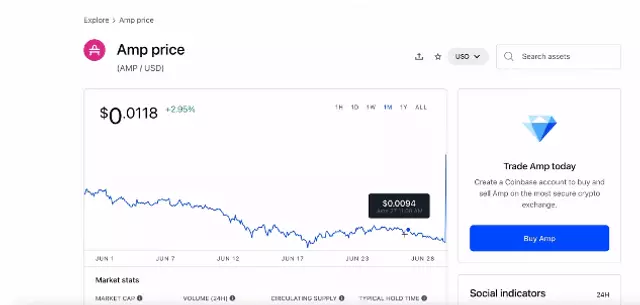

This form of meta-staking is an opportunity for AMP to benefit from the rising market price. While it is difficult to predict when a cryptocurrency will reach a certain price, the AMP token’s price may go up or down depending on various factors. If the market rebounds, AMP will increase in price over the next five years. However, suppose you’re unsure about the future of AMP. In that case, it is best to seek professional advice before investing in the AMP cryptocurrency.

Staking is a popular method for earning passive income in the crypto world. It has recently reached a market cap of $280 billion. The rewards for staking AMP tokens on the Flexa network are comparable to bank savings. In addition to securing the network’s ecosystem, the staking process rewards validators in the same cryptocurrency as the money deposited in the account.

AMP coin is the native cryptocurrency of the Flexa network. It was launched in September 2020. As a relatively new project, it is still on its way to achieving wider adoption. It provides:

- Secure and convenient payment methods.

- A non-inflationary fixed supply.

- Collateral services.

It can also be used to secure items through the Flexa network.