How to Find the Best Stock Average Down Calculator

Add together the invested money and shares purchased columns. By the total number of shares purchased, divide the entire sum invested. By dividing the amount invested by the number of shares purchased at each transaction, you can also calculate the average purchase price for each investment.

If you are looking for a stock average down calculator, you’ve come to the right place. While most traders don’t recommend averaging down, investors can benefit from this strategy. A stock average down calculator can help calculate the average price per share in any market. However, it is not a 100% accurate tool, so it will reflect transaction fees. It is also essential to remember that it is only a rough estimate.

Using a stock average down calculator

When you want to determine the average price of a stock, using a stock average down calculator is a great way to do this. The tool is easy to use and can be adapted to meet your needs. Once you’ve entered your current stock price per share, the stock average down calculator can calculate the total amount of your shares. In addition, the tool will show the fees and commissions associated with the transactions you make.

There are several ways to use a stock average calculator. You can use it to calculate the average cost of stocks in different markets and find out how much you’d lose if you sold your shares too soon. One way to use the tool is to buy a stock at the average price and then wait for it to decrease. Of course, you’ll lose money when you’re waiting for a stock to decrease. But with the stock average calculator, you can quickly know how much you’d lose if you sell it before it increases.

Another way to use a stock average down calculator is to perform a percentage rate analysis. Enter the current price of the stock you’d like to buy and the percentage rate of return you’d like to achieve. The calculator will then consider this information and give you a percentage rate of return. This is an excellent tool to use when you’re trying to calculate your percentage rate of return. If you’re a beginner to the stock market, a stock average down calculator is a great way to get started.

Using a stock average down calculator is an excellent way to determine whether or not it’s worth it to buy more shares of a particular stock. When you buy more shares of a stock, you’ll lower the cost of holding it, making it easier to turn a profit when the price rallies. For example, if you invest $1,000 into a company, you’d be able to purchase 100 shares. That means you’d be paying about $10 for 100 shares. And if you bought more shares at that price, your average price would be around $8 per share.

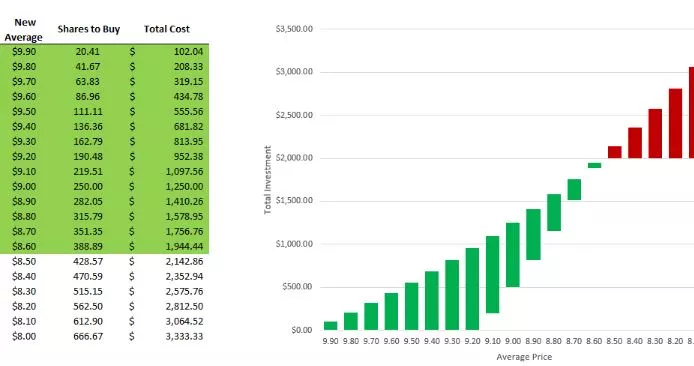

If you don’t want to use an average down calculator, you can go to a website that calculates the average price of your stock. This website will allow you to enter up to ten sets of stock prices and show you an average price for each. Moreover, the calculator will also show you how many shares you’ve purchased and their prices. Some of these websites also generate bar charts that show the differences between the initial and secondary stock purchase prices.

Using a stock average down calculator is a powerful tool for investors. However, it can be time-consuming and requires more work. In addition, the average price of a stock can change drastically. Using a stock average down calculator can help you make this decision quickly. You’ll know how much money you’ve invested in the stock and how much you’ve lost. When you want to make money from stock trading, it is much better to wait for a price increase.

Using a stock average price calculator

A stock average price calculator can help investors reduce the risks associated with their investments. It calculates the average price of a stock and the number of shares purchased. Investors want to minimize their risks by buying stock in small amounts. Using a stock average price calculator is an easy and convenient way. To use it, input the price of each stock and the number of shares you intend to purchase. The calculator will provide you with the average price of all your shares.

Using a stock average price calculator can also help you to minimize your losses. Rather than buying and selling stocks at their highest prices, you can use this tool to see the average price of a stock over a given period. It will help you determine the price range between two consecutive purchase dates, thus smoothing out the volatility of the market. The calculator will need the price of the first and second shares and the number of units you purchased.

A stock average price calculator will also tell you the average price for each trade. This will give you a general idea of how much you need to invest in a given stock to break even. An average price is valuable for investors trading several shares at different prices. If you make more than one buy and sell, you can use an average down calculator to determine how much you need to buy each share to break even.

If you are looking for a free stock average price calculator, you can visit a website where you can download it. Using an average price calculator in an excel spreadsheet will allow you to note each purchase on an excel sheet. This spreadsheet will help you determine the average price of each stock by calculating its weighted average. This can help you ensure you have enough money to cover your expenses. It is an intelligent way to invest and is easier than you think.

A stock average price calculator is an excellent way to protect your investments from massive losses. You can enter the price of a stock, the number of shares you plan to buy, and the new price of each stock. This way, you’ll minimize your losses and make sure to reap the benefits of a stock that has declined in value. In addition, there are a variety of other tools on the Internet that will help you calculate your stock’s average cost.

When using a stock average price calculator, you should enter each stock’s initial and secondary prices. The calculator will then show the average price, the number of shares purchased, and the price of each share. Some sites will even generate bar charts to show the differences between the initial and secondary stock purchase prices. This is a valuable tool for those who want to know how much a stock is worth and to understand the stock market.

Using a stock average price calculator with a spreadsheet

A stock average price calculator can help you determine how much a share is worth. This tool is easy to use and lets you enter up to 10 share averages. All you need to do is enter the price of a share and the number of shares purchased in each buy. If you’re new to the stock market, many books are available to help you get started.

The software can be downloaded for free, and it is free for personal use. It has the basic functionality of calculating the average price of a stock and includes equations and comments to assist you. It uses daily data from Yahoo Finance, including the open and close and historical volatility, and allows you to plot these numbers automatically. The calculator is compatible with both Mac and Windows computers. Using a stock average price calculator with a spreadsheet is easy.

Another free stock average price calculator includes crypto and inventory cost. This spreadsheet is easy to use and has four different options that allow you to get an average cost for any asset. The calculator also allows you to use the same calculation for multiple types of assets. In stock investing, this is called the weighted average. When it comes to tax calculations, the average cost of an asset is used to determine the tax burden if the asset has a capital gain. This article will explain the formula and provide examples. Download a free spreadsheet to get started today.